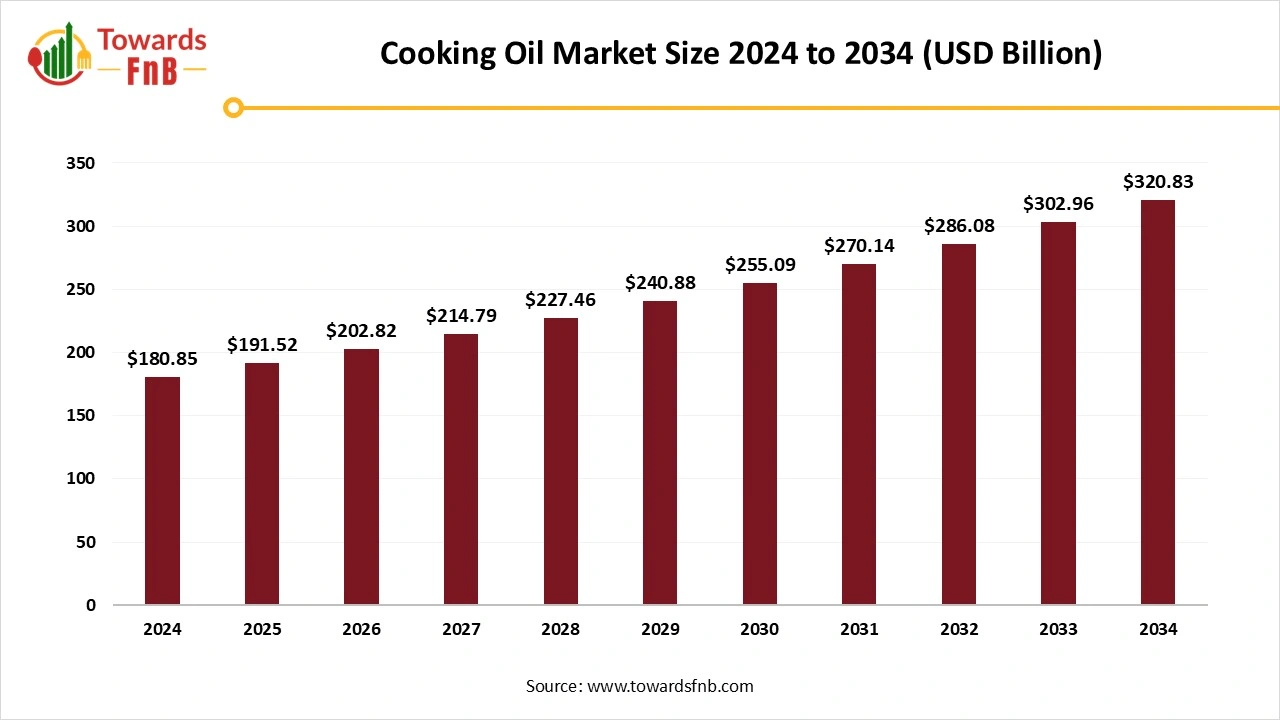

Cooking Oil Market Size Expected to Attain USD 320.83 Billion by 2034

According to Towards FnB, the global cooking oil market size is calculated at USD 191.52 billion in 2025 and is forecasted to hit around USD 320.83 billion by 2034, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. Key drivers include a shift toward premium, organic, and ethically sourced oils, along with government initiatives to boost domestic production.

Ottawa, Aug. 21, 2025 (GLOBE NEWSWIRE) -- The global cooking oil market size stood at USD 180.85 billion in 2024 and is predicted to rise form USD 191.52 billion in 2025 to around USD 320.83 billion by 2034, expanding at a CAGR of 5.9% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The market has been experiencing significant growth in recent years, driven by high demand for processed foods and the expansion of global food chains. High demand for cooking oil alternatives and the growth of various food joints are also helping the growth of the market for cooking oil.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5513

Cooking Oil Market Overview

The global cooking oil market has experienced a huge boom in recent years due to changing dietary preferences, rising health-conscious attitudes, and growing demand for processed food and growing food joints globally. With rising disposable incomes and urbanization, the high demand for premium cooking oils is also driving market growth. The market is also impacted by government initiatives to lower the cooking oil imports and support domestic oilseed cultivation. Ethically sourced cooking oils are highly demanded by consumers in recent periods compared to those who practice traditional methods, driven by growing sustainability concerns. Various forms of packaging available for cooling oils, such as pouches, jars, cans, and bottles, are also helping the growth of the market.

How Indian Government is Supporting Cooking Oil Sector?

- The Government of India has introduced the 2025 VOPPA (Vegetable Oil Products, Production, and Availability) regulation order to tighten oversight of the edible oil sector. This law, which came into effect on August 1, 2025, imposes stringent restrictions, mandates monthly reporting, and empowers officials to inspect and take action against non-compliance. The VOPPA regulation is an extension of the 2011 Vegetable Oil Products Production and Availability Regulations, notified under Section 3 of the Essential Commodities Act, 1955, by the Ministry of Consumer Affairs, Food, and Public Distribution.

- India aims to nearly double its domestic edible oil production from 12.7 million tons to 25.45 million tons by 2030-31, covering 72% of the projected demand.

- As part of its efforts, New Delhi is working to manage the increased supply of Distillers Dried Grains with Solubles (DDGS) in the market. The government's support, through regulatory measures, financial incentives, and infrastructure development, can play a crucial role in enhancing domestic production, improving supply chain efficiency, and reducing dependency on imports. By fostering growth in this sector, India can not only meet its increasing demand but also build a robust, self-sustaining edible oil industry.

Key Highlights of the Cooking Oil Market

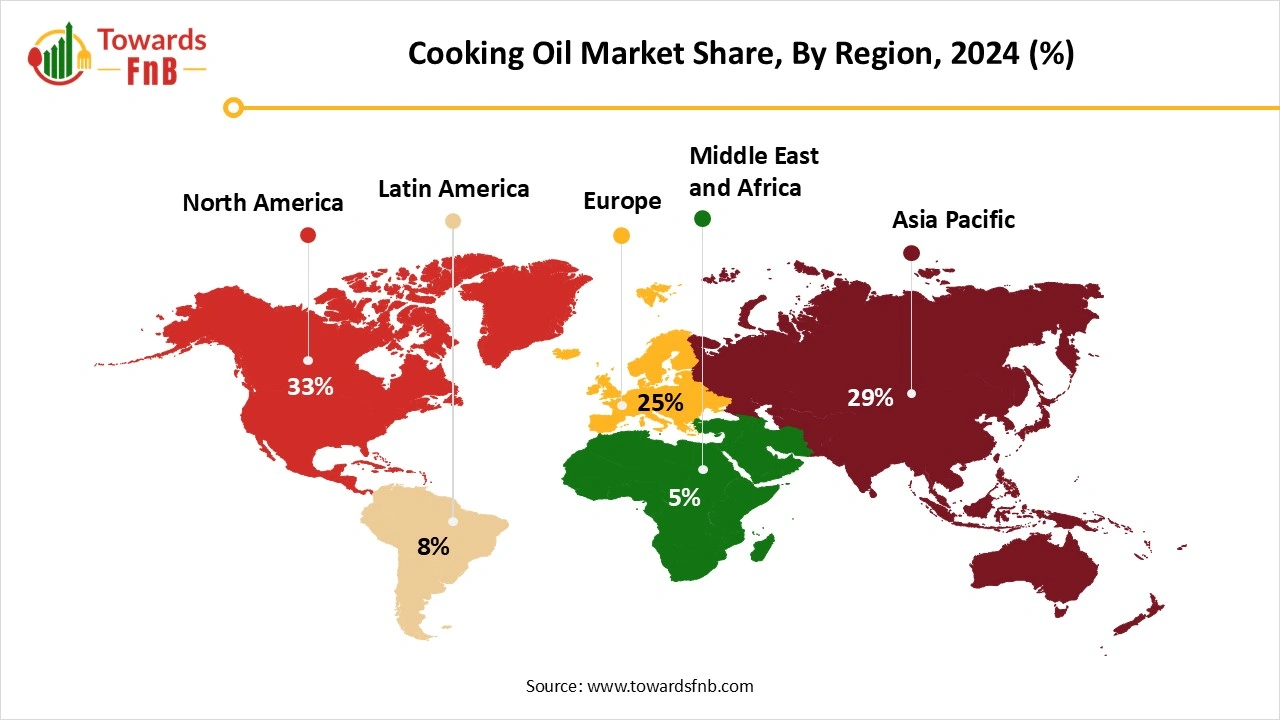

- By region, Asia Pacific dominated the cooking oil market, whereas North America is expected to grow in the foreseeable period, as the region is home to huge oil resources, driving the economy.

- By product type, the palm oil segment led the cooking oil market in 2024, whereas the soy oil segment is expected to grow in the foreseeable period as it is a popular harvesting option among farmers.

- By end-user type, the residential segment led the market for cooking oil in 2024, whereas the food service segment is expected to grow in the expected timeframe due to the rising number of food joints globally, along with maintaining sustainability factors.

- By distribution channel, the supermarkets and hypermarkets segment dominated the cooking oil market in 2024, whereas the online segment is expected to grow in the foreseen period due to its convenience factor.

New Trends in the Cooking Oil Market

- Higher preferences for healthier cooking oils with low levels of saturated fats and higher levels of unsaturated fats are helping the growth of the cooking oil market. Oils such as rice bran oil, canola oil, and olive oil are ideal examples of such oils.

- Growth of fortified oils due to FSSAI’s mandate, enriched with vitamin A and vitamin D, is also helping the growth of the market.

- Cooking oils related to targeting certain health issues involving a blend of oils are also helping the growth of the market for cooking oils.

- High demand for cold-pressed and organic oils is another major factor for the growth of the cooking oil market.

- Sustainability trends have led to a surge in consumer preference for oils that are ethically sourced and produced using sustainable methods. Companies are increasingly adopting certifications like RSPO (Roundtable on Sustainable Palm Oil) to ensure environmentally friendly palm oil sourcing.

How Has AI Impacted the Cooking Oil Market?

Artificial intelligence (AI) is increasingly benefiting the cooking oil market by enhancing efficiency, innovation, and consumer engagement. One of the major applications of AI lies in production and quality control, where machine learning models and image recognition systems help monitor raw materials, detect impurities, and maintain consistent product quality. AI-driven predictive analytics also optimize refining processes, reducing energy consumption and improving yield, which lowers costs while supporting sustainability initiatives. In product development, AI analyzes consumer preferences, health trends, and dietary data to help manufacturers create healthier oil blends, such as low-cholesterol, fortified, or functional oils enriched with omega-3 or vitamins.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/cooking-oil-market

Recent Developments in the Cooking Oil Market

- In August 2025, Indian Oil Corporation (IOC) announced India’s launch of 1st sustainable fuel plant in Panipat, turning cooking oil into jet fuel. The IOC recently also secured ISCC CORSIA certification, a global standard allowing airlines to use biofuel under international carbon offsetting fuels. (Source- https://curlytales.com)

- In January 2025, the Agriculture Ministry launches the first-ever national edible oil consumption survey to assess the edible oil consumption pattern in India. The main aim of the survey is to effectively implement the new mission on Edible Oils-Oilseeds (NMEO-Oilseeds). (Source- https://www.thehindu.com)

Case Study: Idhayam's Strategic Expansion in the Cooking Oil Market

Idhayam is a leading cooking oil brand in India, primarily known for its sesame oil and groundnut oil. Established in 1986, the company has become a prominent player in the market. With the growing consumer shift towards health-conscious oils, Idhayam faced the challenge of differentiating itself in a saturated and competitive market, while also catering to a diverse consumer base across urban and rural regions.

Challenge:

- Market Saturation: Intense competition in the Indian cooking oil sector.

- Price Sensitivity: Rural markets required affordable premium oils.

-

Consumer Shift: Growing preference for healthier oils like sesame and groundnut.

Solution:

- Focus on Quality: Idhayam ensured pure, high-quality sesame and groundnut oils to cater to health-conscious consumers.

- Regional Customization: Tailored offerings to suit regional tastes sesame oil for South India and groundnut oil for the rest.

- Health-Conscious Branding: Positioned oils as a healthier alternative to traditional oils.

- Global Expansion: Expanded into 49 countries, tapping into global demand for healthier oils.

- Sustainability Practices: Implemented eco-friendly sourcing and green manufacturing.

Outcomes:

- Market Leadership: Achieved 90% market share in sesame oil and 70% in groundnut oil.

- Global Reach: Expanded to 49 countries.

- Revenue Growth: Generated Rs. 569 Crores annually.

- Sustainability Recognition: Built a strong brand image focused on ethical sourcing and eco-friendly production.

Conclusion

Idhayam’s strategic focus on quality, regional customization, and health-conscious marketing helped it dominate the Indian market and expand globally. Its success illustrates how brands can leverage consumer health trends and sustainability for long-term growth.

Market Dynamics

What Are the Growth Drivers of the Cooking Oil Market?

Urbanization, growing population, changing dietary preferences, growing food joints globally, and rising preferences for healthy cooking oil alternatives are some of the major reasons for the growth of the cooking oil market. Rising disposable incomes leading to higher demand for premium cooking oils is another major factor for the growth of the market. Health-conscious consumers in search of healthy oils with lower saturated fat content, such as olive oil or rice bran oil, are also helping the growth of the market. Government initiatives for lower cooking oil imports and higher oilseed cultivation are also helping the growth of the market.

Challenge

Changing Raw Material Prices Are Hampering the Market’s Growth

Fluctuating prices of raw materials due to various reasons, such as agricultural problems, weather conditions, or geopolitical issues, hinder market growth. Due to such issues, the raw material costs are hiked up further, fueling the prices of cooking oils. Hence, such issues act as a barrier to the growth of the cooking oil market. Such issues also disturb the pricing strategies and production of the manufacturers.

Opportunity

Rising Demand for Cooking Oils Is Helping the Growth of the Market

The demand for cooking oils has increased in recent periods due to changes in dietary preferences, a growing population, urbanization, and the growth of food joints globally. Recycling of oils for using them in soaps, animal feed, fuel, and various industrial products also helps to give a push to the cooking oil market for its growth.

Cooking Oil Market Regional Analysis

Asia Pacific dominated the Cooking Oil Market in 2024

Asia Pacific dominated the cooking oil market in 2024 due to the availability of different types of oil in the region. The region is full of healthy oils, such as a range of virgin oils and fruit-infused oils. Use of sustainable methods for the manufacturing of different types of oils is another major factor helping the growth of the cooking oil market. Growing health awareness and rising disposable income, leading to demand for healthy oils, are also among the vital factors for the growth of the market.

North America is expected to grow in the Expected Timeframe

North America is expected to grow in the foreseen period, helping the growth of the cooking oil market in the foreseen period. Rising health awareness and the importance of choosing the right cooking oil for a healthy lifestyle are helping the growth of the market in the foreseeable period. People following plant-based diets and prefer to follow certain diets by using certain types of oils are also helping the growth of the market.

Cooking Oil Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 5.9% |

| Market Size in 2024 | USD 180.85 Billion |

| Market Size in 2025 | USD 191.52 billion |

| Market Size by 2034 | USD 320.83 billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Cooking Oil Market Segmental Analysis

Product Type Analysis

The palm oil segment dominated the cooking oil market in 2024 due to its high usage in the household and for industrial purposes. Palm oil is easily available, affordable, versatile, and is a popular choice for cooking and other purposes, further fueling the growth of the market. A well-established global supply chain, making the oil easily available in different markets, is another major factor for the growth of the market in 2024.

The soybean oil segment is expected to grow in the foreseeable period due to its high demand in the cooking oil sector and for various household purposes. It is also highly preferred by farmers for harvesting, making it a prime choice for them, further fueling the growth of the market. The oil is also a vital fuel alternative, as one can easily derive biodiesel and renewable diesel from soybean oil, further enhancing the growth of the market. The form of oil is highly used for cooking as its neutral flavor profile pairs easily with any dish.

End-User Type Analysis

The Residential Segment dominated the Cooking Oil Market in 2024

The residential segment led the cooking oil market in 2024 due to high usage of different types of cooking oils for different types of cooking, such as deep frying, stir frying, making dips, marinations, barbeque, baking, and for various other cooking techniques. Cooking oils are available in different types as per the dietary preference of each consumer and as per different health goals. Cooking oils play a vital role in the growth of the market. Hence, the segment led the market in 2024.

The food service segment is expected to grow in the foreseeable period due to the growth of population, urbanization, and changing dietary preferences, further fueling the growth of the cooking oil market. Use of the right kind of cooking oil with the right smoke point is essential to maintain the quality of food service. Hence, the segment plays a vital role in the growth of the market for maintaining efficiency and sustainability as well.

Distribution Channel Analysis

The supermarkets and hypermarkets segment led the cooking oil market in 2024 due to multiple reasons, such as easy accessibility to different types of oils. Availability of healthy cooking oils for health-conscious people by different brands is another major factor for the growth of the segment, further fueling the growth of the market. The availability of a variety of brands in different price ranges, which is helpful for different types of consumers to shop for their specific brands, is helping the growth of the segment.

The online segment is expected to grow in the foreseen period due to its convenience factor, allowing consumers to shop for their favorite cooking oil and their preferred brands available in different price ranges. One can also use different types of coupons and discounts available in online shopping and make their experience an economical one. The segment allows consumers to get their favorite products at the convenience of their doorstep, helpful for a certain sect of consumers. Growth of e-commerce platforms is also helping the growth of the market due to easy availability of products in different price ranges, along with their detailed reviews.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Organic Food Market: The global organic food market size was calculated at USD 228.38 billion in 2024 and is expected to grow steadily from USD 253.96 billion in 2025 to reach nearly USD 660.25 billion by 2034, growing at a CAGR of 11.20% over the forecast period from 2025 to 2034.

- Dietary Supplements Market: The global dietary supplements market size was reached at USD 192.68 billion in 2024 and is predicted to increase from USD 210.41 billion in 2025 to USD 464.58 billion by 2034, with an expected CAGR of 9.2% during the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size reached at USD 18.70 billion in 2024 and is expected to grow steadily from USD 20.33 billion in 2025 to reach nearly USD 43.07 billion by 2034, with a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Non-Alcoholic Beverages Market: The global non-alcoholic beverages market size reached at USD 1,308 billion in 2024 and is anticipated to increase from USD 1,406 billion in 2025 to an estimated USD 2,696 billion by 2034, witnessing a CAGR of 7.5% during the forecast period from 2025 to 2034.

- Frozen Food Market: The global frozen food market size reached USD 203.15 billion in 2024 and is projected to grow from USD 214.32 billion in 2025 to nearly USD 347.01 billion by 2034, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Dry Fruit Market: The global dry fruit market size reached USD 7.10 billion in 2024 and is expected to grow steadily from USD 7.47 billion in 2025 to reach nearly USD 11.79 billion by 2034, expanding at a CAGR of 5.20% during the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size was valued at USD 165.28 billion in 2024, and is expected to grow steadily from USD 173.71 billion in 2025 to reach nearly USD 271.80 billion by 2034, with a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Vegan Food Market: The global vegan food market size was calculated at USD 20.22 billion in 2024 and is anticipated to increase from USD 22.38 billion in 2025 to an estimated USD 55.88 billion by 2034, witnessing a CAGR of 10.7% during the forecast period from 2025 to 2034.

Key Players in the Cooking Oil Market

- Cargill

- Bunge Limited

- Wilmar International Limited

- Dhara

- Patanjali Ayurved

- Saffola

- Emami

- Marico

- Conagra Brands Inc

- Dalda

- Disano

- Fortune

- Louis Dreyfus Company

- NatureFresh

- Sundrop

- Dabur

- Figaro

Segments Covered in the Report

By Product Type

- Palm Oil

- Soy Oil

- Sunflower Oil

- Peanut Oil

- Olive Oil

- Rapeseed Oil

- Others

By End User

- Residential

- Food Services

- Food Processing

By Distribution Channel

- Supermarket/Hypermarket

- Independent Retail Stores

- Business to Business

- Online sales channel

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5513

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️ Sugar-Free Food Market: https://www.towardsfnb.com/insights/sugar-free-food-market

➡️ Snack Food Market: https://www.towardsfnb.com/insights/snack-food-market

➡️ Food Additives Market: https://www.towardsfnb.com/insights/food-additives-market

➡️ Confectionery Market: https://www.towardsfnb.com/insights/confectionery-market

➡️ Personalized Nutrition Market: https://www.towardsfnb.com/insights/personalized-nutrition-market

➡️ Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️ Baking Ingredients Market: https://www.towardsfnb.com/insights/baking-ingredients-market

➡️ Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️ Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️ Smoothie Market: https://www.towardsfnb.com/insights/smoothie-market

➡️ Pet Food Market: https://www.towardsfnb.com/insights/pet-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.